28+ Early debt payoff calculator

With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. Best and worst states for retirement.

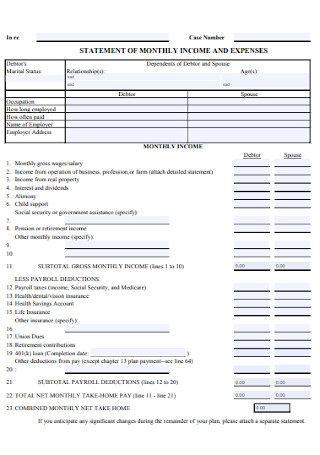

28 Sample Income And Expense Statements In Pdf Ms Word

If youre not sure how much extra payment to add to payoff your mortgage by a given date try this mortgage payoff calculator here to figure the payoff in terms of time instead of interest saved.

. 23 You can customize your snowball plan to suit your needs. If youre in the. But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Get 247 customer support help when you place a homework help service order with us. And the borrower will pay off the debt.

Lenders also require higher credit scores for shorter terms that increase your monthly debt service expenses. But if you have a 30-year fixed mortgage you can still shorten your payment term by paying extra. Aside from selling the home to pay off the mortgage some borrowers may want to pay off their mortgage earlier to save on interest.

Sometimes paying off your mortgage loan too early can cost you money. The loan is secured on the borrowers property through a process. Once the user inputs the required information the Mortgage Payoff Calculator will calculate the pertinent data.

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. Losing out on paying higher-interest debt. 21 This method will build momentum as time goes by.

Table of Contents. December 28 2020 at 414 pm I was able to select a debt reduction method but could not press the next button to see the results or. Making it ideal for paying off credit card debt consolidating other high-interest debt.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. To illustrate how bi-weekly payments work lets compare it with monthly payments. Use this debt payoff calculator to see when youll be debt free with the debt snowball method.

Using our calculator above you can estimate the savings difference conveniently. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners. Then make sure you click on the Supporting Schedules button.

2 The benefits of using the debt snowball method. Early repayment means lenders lose profits they could have earned from interest. Use our free mortgage calculator to estimate your monthly mortgage payments.

Prior to 2014 some conventional lenders required steep prepayment penalties that stretched for the entire loan. A prepayment penalty is a fee lenders charge if you pay all or a percentage of your mortgage early. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early. About 90 percent of student loan debt is comprised of federal loans with interest rates ranging from 499 percent to 754 percent. Credit card payoff calculator.

Calculate the investment return between early payoff date and current payoff date. Early or Late Retirement. Enjoy a one-time bonus of 75000 miles once you spend 4000 on purchases within 3 months from account opening equal to 750 in travel.

Here are steps you can take to lighten. Account for interest rates and break down payments in an easy to use amortization schedule. Accessed Jul 28 2022.

We surveyed over 2000 consumers to find out how they use. Earn unlimited 2X miles on every purchase every day. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

1 to 7 business days. 1 Debt Snowball Spreadsheets. Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower.

There youll find all the supporting number that went into the above analysis. Private mortgage insurance PMI you made a 20 down payment worth 65000. If you have credit card or student loan debt funneling your extra cash toward paying off your mortgage early can actually cost you in the long run.

Buy now pay later BNPL services can help consumers avoid credit card interest but they also present financial risks to the unprepared. 3 Debt Snowball Worksheets. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers.

This multiple debt payoff calculator tests 5 debt payoff methods to tell you including debt snowball debt avalanche. Outlined below are a few strategies that can be employed to pay off the mortgage early. 4 How does the snowball method for paying off debts work.

This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. Todays national mortgage rate trends. On Wednesday September 14 2022 the current average rate for a 30-year fixed mortgage is 624 up 13 basis points over the last week.

Prepayment penalties are fees that are owed if you pay off a loan before the term ends. 22 You can negotiate the interest rates. Flexible terms does not require collateral.

Traditional IRA calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Best age to take Social Security.

Theres a detailed amortization schedule showing the periodic payment and interest charges as well as the extra payments coming off the principal balance. After the loan payment schedule youll find a future value or investment. Lenders impose prepayment penalties to discourage consumers from prepaying their loan selling their home early or refinancing their mortgage.

How to avoid early. Some lenders may allow you to. Theyre a way for the lender to regain some of the interest they would lose if the account was paid off early.

In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. Paying Off a Mortgage Loan Early.

28 Sample Income And Expense Statements In Pdf Ms Word

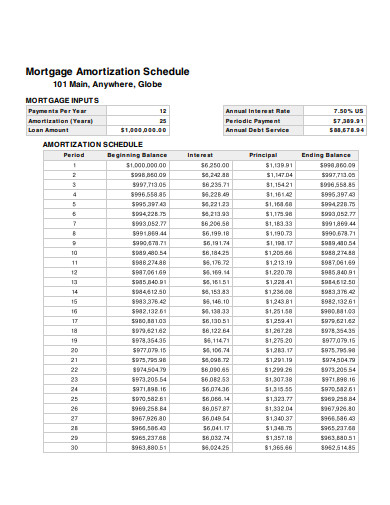

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

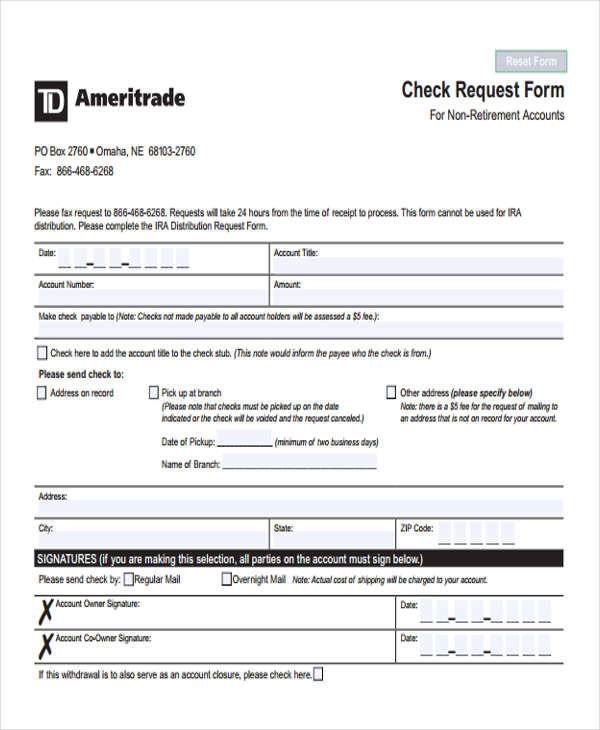

28 Free Credit Card Authorization Forms Templates Word Pdf Bestcollections

28 Free Credit Card Authorization Forms Templates Word Pdf Bestcollections

Tables To Calculate Loan Amortization Schedule Free Business Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Professional Templates Excel

Free Account Statement Templates Excel Word Best Collections

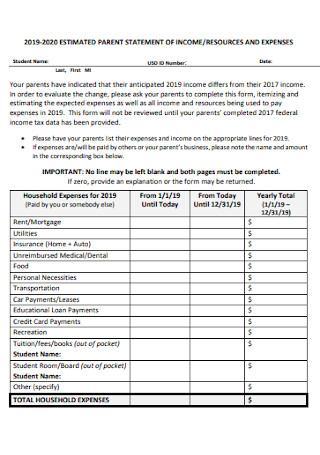

28 Sample Income And Expense Statements In Pdf Ms Word

30 Handy Business Budget Templates Free Business Legal Templates

Free 28 Check Request Forms In Pdf Ms Word Excel

45 Best Startup Budget Templates Free Business Legal Templates

Business Cards For Students Student Business Card Request Survey Student Business Cards Student School Of Education

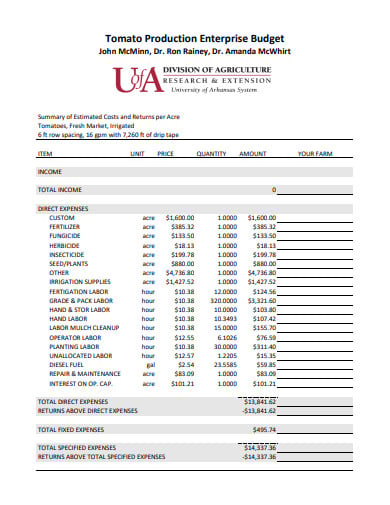

11 Production Budget Templates Google Docs Google Sheets Word Pages Numbers Pdf Excel Free Premium Templates

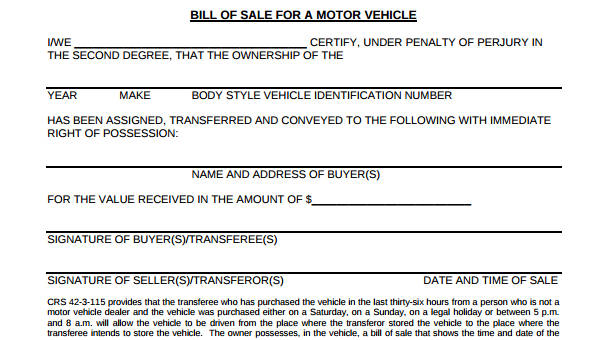

Free 28 Sample Bill Of Sale Forms In Pdf Ms Word

28 Free Credit Card Authorization Forms Templates Word Pdf Bestcollections